Kenya: leading in IT innovation

M-Pesa money transfer service has led the way to better, faster business

By Mark Kapchanga

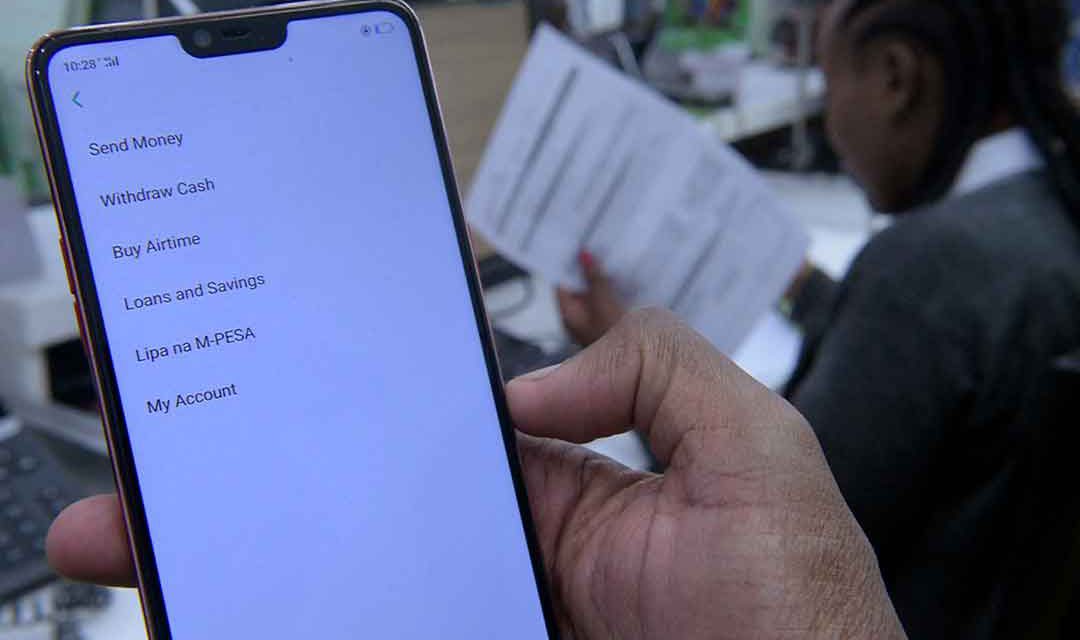

Before 2007, Dickson Rono would rely entirely on Kenya’s slow, cumbersome and expensive banking infrastructure to pay bills and receive payments from clients. Today, thanks to mobile money transfer service M-Pesa, the managing director of Ron TV International, a documentary and filmmaking company in Nairobi, can use his mobile device as a virtual bank. M-Pesa, launched by telecoms operator Safaricom turns even the most basic cellular telephones into mobile banks, and this has revolutionised the way businesses are run in the east African country. “I don’t waste time queuing every end of the month to pay taxes. I just go to my phone, check how much I owe the Kenya Revenue Authority, and then pay the sum through M-Pesa,” says Mr Rono. “As a result, I am saving about two hours every month, translating to 24 hours in a year. This has enabled me to hire two more staff members.”

The innovation has attracted international attention. In February 2015, Microsoft founder Bill Gates heaped praise on the mobile money transfer service, saying M-Pesa is “an innovation that I think would trickle up from developing countries to the rich world”. Indeed, so important has been the M-Pesa innovation that two years after its launch, it already had six million customers, transferring billions of shillings annually. The technology is finding other applications. Using his mobile phone, Mr Rono can also access a loan, known as M-Shwari, a joint service offered by Safaricom and the Commercial Bank of Africa. With M-Shwari, an individual or a business can access affordable emergency loans. Betty Mwangi-Thuo, the general manager for financial services at Safaricom, says the product’s key goal is to change the lives of millions of Kenyans and enterprises. “There is no paperwork for one to borrow or save using this revolutionary banking platform.

This is the kind of product most start-ups and small businesses in Kenya have been yearning for: fast, affordable and user-friendly,” says Ms Mwangi-Thuo. Since its launch in 2012, M-Shwari’s uptake has been massive. Safaricom’s latest statistics on the product show that the average loan size to customers is between Sh1,700 ($17) and Sh2,000 ($20). On the other hand, the average savings amount is between Sh550 ($5.5) and Sh600 ($6). Through M-Shwari, Safaricom is now reaching millions of people who previously could not access banking services in Kenya. According to the Commercial Bank of Africa, M-Shwari has 11 million users, 5.8 million of whom are active. It has extended loans totalling Sh29 billion ($290 million), processing an average of 50,000 loans per day, since its launch. “We expect these figures to rise tremendously in the coming years,” says Ms Mwangi-Thuo.

Its success in transforming business culture, particularly among small businesses and start-ups, has seen M-Pesa widen its reach to offering health insurance among the poor who would otherwise not have access to it. M-Pesa is used by health insurance service provider, Linda Jamii, as its premium collection platform for subscribers who pay an annual premium of Sh12,000 ($120) for medical cover including dental, maternity, optical, in- and out-patient, and funeral expenses. Analysts say internet-driven innovation like this can improve not only access, but also efficiency of healthcare related spending by between 10% and 20%, while reducing drug counterfeiting by about 80% in Africa. Remote diagnostics and telemedicine could address 80% of the health issues of patients in rural clinics, which are mostly understaffed, says Dr Emmanuel Manyasa, an economist and university lecturer.

The internet has already enabled automation and centralisation of patient admissions, health records and supply chains in Kenyan hospitals. These advances have placed Kenya as second only to Senegal in sub-Saharan Africa in iGDP ratings, the measure of the internet’s contribution to a country’s economic income, according to a McKinsey Global Institute study. Senegal is the only African country in the top ten countries with the highest iGDP (3.3%) in the world, ahead of India (3.2%) and below the US (3.8%). Kenya, at 2.9%, ranks higher than China at 2.6%. Morocco is at 2.3%, Mozambique at 1.6%, and Brazil at 1.5%. Currently, Africa’s iGDP stands at $18 billion and is expected to reach $300 billion by 2025, according to the study. “This internet economy has started to pay dividends with an exponential surge seen, for example, in the recent Ease of Doing Business index.

Innovation, coupled with a degree of global fluency, is making Kenya an attractive investment hub,” observes Aly Khan, an economist in Nairobi. Through the internet revolution, Kenya has also become a launching pad for a new generation of digital entrepreneurs. Education institutions use digital tools to deliver rapid gains in access to education, teacher training, and learning outcomes. At Kenyatta University, for example, students who once had few or no textbooks are now able to log on and learn with the world’s best educational content on affordable tablets or e-books. So, what prompted Kenya to become one of Africa’s technology hotspots? Mr Satchu believes Safaricom’s M-Pesa was the game-changer, adding that the regulator (Communications Authority of Kenya) deliberately stepped aside and allowed the M-Pesa economy to develop.

This has been supported further by the government’s commitment to developing a thriving ICT sector. “Kenya has made substantial investments in ICT infrastructure, and developed the supporting policy and legal frameworks to enable rapid growth of the sector,” says Joe Mucheru, the ICT cabinet secretary. These include the Kenya Communications Amendment Act of 2009, the Information and Communications Regulatory Guidelines of 2010 and the Special Economic Zone Policy and Legal Frameworks of 2012. Experts say infrastructure projects like the East African Marine Systems and the Notational Optic Fibre Backbone Infrastructure have upgraded and strengthened broadband and communications systems in Kenya, creating a suitable ground for innovation. Moreover, Kenya has a strong network of public and private sector ICT research and development hubs such as the University of Nairobi’s Fab Lab, Strathmore University’s iLab Africa, and the private but growing iHub, says Professor Ndemo.

IBM and Nokia have also established global research centres in the region. Other global heavyweights that have set up operations in Nairobi in the past three years include General Electric, Google, Visa International, Pepsi, Nestlé, Foton Automobiles, the World Bank’s International Finance Corporation, South Africa’s FirstRand Bank, PricewaterhouseCoopers, advertising agency WPP, Bharti Airtel, Huawei and Procter & Gamble. More multinationals are likely to set up shop in Kenya upon the completion of Konza Technology City, located 60 kilometres south-east of Nairobi. This technology hub will have four main economic sectors: education, life sciences, telecommunications and business process outsourcing, Professor Ndemo says Konza, sometimes referred to as Africa’s “Silicon Savannah”, will significantly stimulate technology spending, investment and growth in Kenya, creating more than 20,000 jobs in the first phase alone.

Konza was initially conceived in 2008 by the Kenyan government to capture the growing global business processing, outsourcing and information technology-enabled services sectors in Kenya. These sectors had produced $110 billion in revenues in 2010. By 2015, the revenues had increased almost three-fold to $300 billion. Though Mr Satchu fears that the Silicon Savannah’s dream may not be as alive as originally envisaged, he argues that “innovation is finding its own home and, yes, there is a process of ‘Uberisation’ going on”. Cabinet secretary in the ministry of industry, investment and trade, Adan Mohamed, says Kenya is cutting down on red tape in procedures related to doing business. “This year we climbed 21 places (from 129 to 108) in the ‘Ease of Doing Business’ 2016 index. We have shown consistent efforts in transforming the local business landscape and leveraging Kenya’s competitive business environment. Contributors to the rise include improvements in starting a business, getting electricity, registering property and getting credit.”

Besides individual country’s efforts to better their business landscape, there has been an ongoing peer-to-peer review of the key reforms needed to boost business. For example, the Ease of Doing Business Initiative (EDBI), launched in August 2010, allows African countries to learn and share information, experiences and good practice. Addressing an EDBI conference held in Nairobi in May 2016, President Uhuru Kenyatta said that African countries need to aggressively fight corruption, oppressive laws, ineffective policies and political interference to improve the business environment. “The key to sustainable industrial growth and job creation lies in the growth of domestic companies and the attraction of local and foreign investors to invest capital and expertise into the economy. To achieve this, we have made improving the overall business climate and supporting selected sectors our top priorities.”

The launch of Huduma Centres, or digital “one-stop shops”—with 32 branches serving more than 35,000 people a day and offering over 44 different public services per centre, from issuance of business permits to tax payments—has been pivotal in this change.

Mark Kapchanga is a senior economics writer for the Standard newspaper

in Kenya and a columnist for the Global Times, an English-language newspaper

in China. He is pursuing a PhD in investigative business journalism at the

University of Nairobi.