South Africa’s Presidential Commission on the Fourth Industrial Revolution (PC4IR) admittedly took form in a global environment in which other major countries had already established leadership roles and represented a disproportionate amount of the design and manufacturing of advanced and emerging technologies.

At the same time, South Africa has deep commercial ties to the Peoples’ Republic of China (PRC) and the US, in addition to longstanding and growing cultural tethers with the two countries respectively. The announcement, convening, work and report of the PC4IR all coincided with the US-China trade war (2018-2020), which some scholars argued to be a new Cold War.

As such, the final form of its strategy, represented by the 2020 Report of the Presidential Commission on the 4IR, is a potentially informative contemporary artefact meriting study for ascertaining the direct and/or indirect influences of China and the US in 4IR industrial planning in South Africa.

This article presents an analysis of South Africa’s 4IR strategy in comparative perspective against China and the US. The article draws from a thematic analysis of the PC4IR’s report. It determines whether South Africa’s 4IR strategy has drawn inspiration from the 4IR strategies of the two world powers (and, if so, how much compared to the other), or whether its strategy may be said to be exclusively made in South Africa.

The findings show that South Africa does not excessively lean one way or the other. Also, the trade war has had no discernible influence. South Africa mentions both countries in a good light in its strategy. The findings show, also, that the differences between China and the US may be exaggerated to some degree. Indeed, there are overlaps across all three countries. All three, for example, seem to identify a role for government involvement and even direction in enhancing their positions in the 4IR. All three reports are unequivocal in this regard. Moreover, South Africa has approached the 4IR from a developmental perspective, whereas China and the US are more competitive, efficiency and security minded. Thus, they are time-specific (both setting 2025 as a crucible point) whereas South Africa is open-ended.

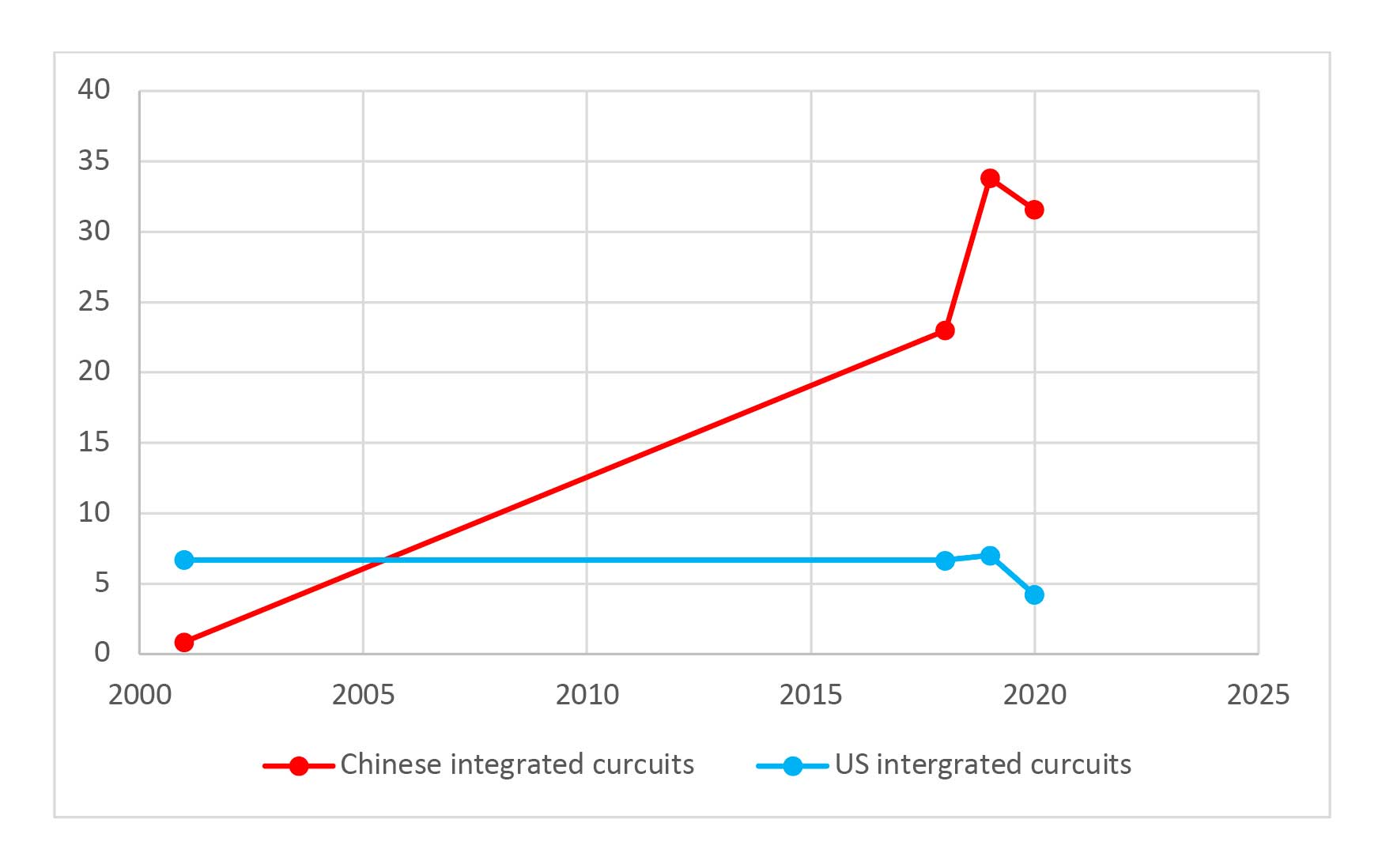

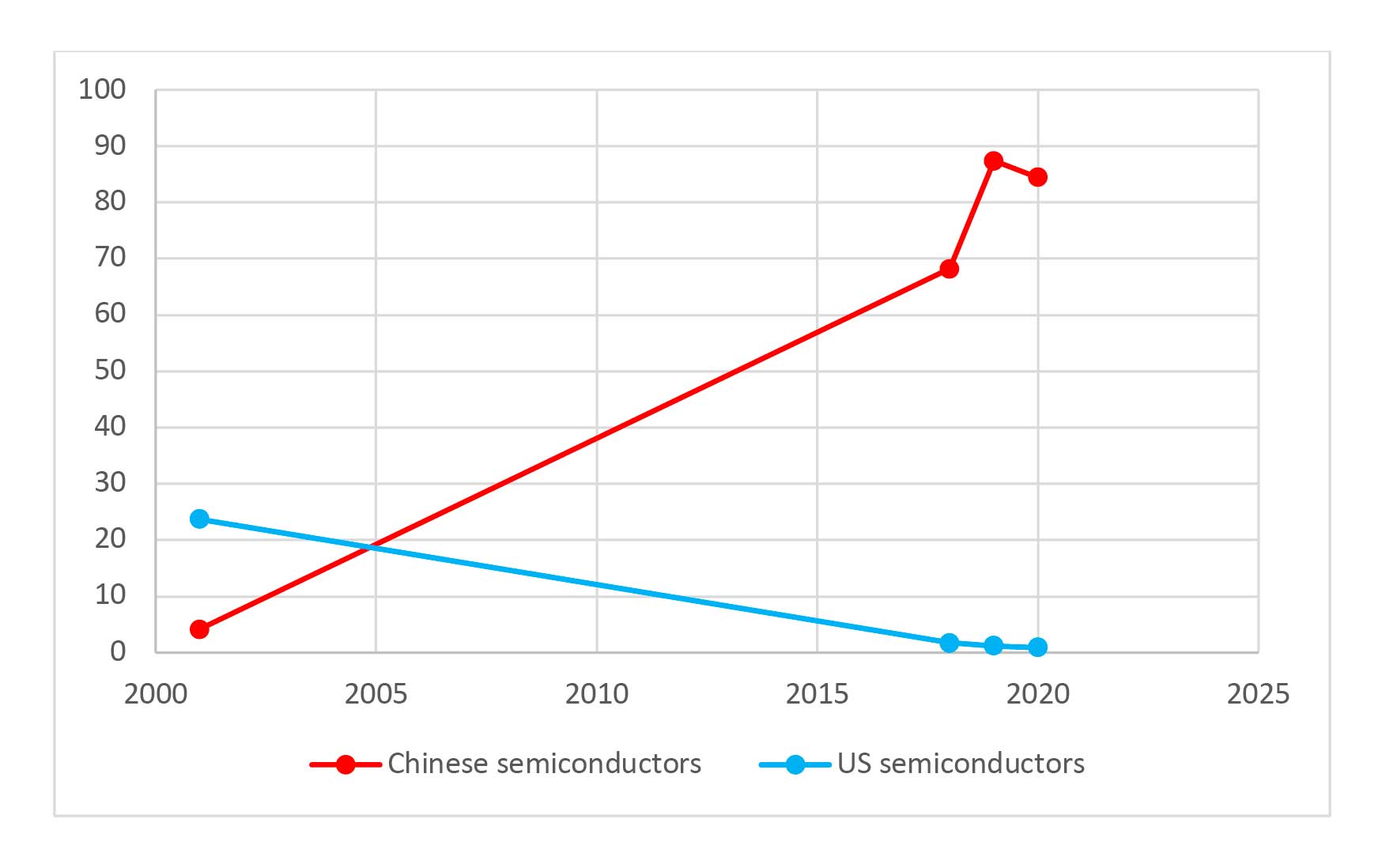

It is worth considering, briefly, the role of both countries in South Africa technology production. A viable proxy for this is the total share of either country in South Africa’s computer chip imports. Chips are crucial because they are components of all technology products, and it is telling where South Africa has historically and currently sources this crucial ingredient.

The US and China continue to invest in data centres across the globe to process and store the big data generated by the 4IR. Photo: Getty Images

The share of each country in South Africa’s total imports of each product is represented in Figure 1 and Figure 2. Overall, China’s share began lower than that of the US in 2001 but has since supplanted it on both products. For example, China’s range of 23% (2018) and 33.8% (2019) outcompetes the US’s 4.2% (2018) and 7% (2019).

South African imports of integrated circuits from China and the US, 2018-2020 (2001 benchmark). Graph: Author, with data from United Nations ITC.

The extent to which global developments informed South Africa’s 4IR report is indicated in the document itself. It states that: “[We] understand that in the context of a globalised society, competition and wellbeing are not only about our own standards, but also relative to the quality of economic and social life enjoyed in other nations. To this end, in determining the socioeconomic impact of the 41R path that South Africa embarks upon, we will also keep a firm eye on the strategies that other countries are undertaking to ascertain gaps and opportunities, both locally and internationally. The concept of 4IR is new. Therefore, only a handful of countries have developed strategies in response to this unfolding current revolution in anticipation of a different future reality”.

These trends and admissions, therefore, beg the question of where SA’s strategy stands between these two technology superpowers. The question is asked along four key sub-questions. Firstly, has there been any direct role for entities from either country in the development of the South African strategy? Secondly, what actors (government or private sector) are emphasised in each strategy, and how does South Africa position itself? Thirdly, what approach does each have towards ethics and data? Finally, what key technologies are emphasised, and what can that tell us about the nature of each country’s strategy and South Africa’s own posture? Each of these is important and merits analysis. Considered together, they allow for comprehensive analysis of all the important components of national strategy as understood through the literature.

South African imports of semiconductors from China and the US, 2018-2020 (2001 benchmark). Graph: Author, with data from United Nations ITC.

The findings to each of the four questions are presented. Firstly, the report itself seems to have been written with a greater role for the US in mind, the three US organisations (Amazon, Cisco and the American Chamber of Commerce in South Africa) that were consulted, whereas that was not the case with Chinese entities (Presidential Commission on the Fourth Industrial Revolution, 2020: xviii-xix). Thus, South Africa, despite its rhetorical scepticism towards Donald Trump’s US and open embrace of Huawei, still made overtures to US players in formulating its strategy. Notably, also, trade with the US grew in this period. This would seem to demonstrate that South Africa has been impervious to the so-called new Cold War.

Secondly, in all three countries, it is clear that the government is seen as central in the inception and execution of 4IR technologies, in addition to coordinating efforts that are going on in the private sector. This fact perhaps represents a contemporary equivalent of how governments respond to the development of frontier industries in a geopolitically charged environment. A key difference, however, is to be noted in the motivation for governmental involvement. For both China and the US, the major driver behind governmental leadership in 4IR development is competition with one another, whereas for South Africa it is socioeconomic development (i.e., employment creation and reduction of inequality).

There is also a clearer focus on education that is shared by both the US and South Africa. For its part, the US strategy states that the US Congress should enact a “National Defense Education Act II”, whose task would be to diminish current inadequacies of the US education system and thus make way for more AI-related K-12 education and job re-skilling. Similarly, the first of the eight recommendations made in the case of South Africa is “investing in human capital”, noting that “the 4th IR gives us a rallying point of urgency and an opportunity to redesign, streamline and align the education system through a coordinated, robust, multi-stakeholder process” (Presidential Commission on the Fourth Industrial Revolution, 2020: 50).

Thirdly, South Africa’s strategy document recognises the centrality of ethics in the development of emerging technologies: “A focus on regulation, ethics, and cultural aspects of the internet is key, not only to create an enabling policy environment to support private and non-governmental organisations, as well as the state, but to ensure ethical and transparent use of these new technologies” (Presidential Commission on the Fourth Industrial Revolution, 2020: 28). The document, however, also encourages the exploitation of data, albeit within the constraints of the law. This is more akin to the US than China.

The 4th industrial revolution is speculated to change the world we live in through advances in microelectronics, biotechnology, quantum computing, robotics and energy storage technology, to name a few. Photos: Getty Images

Moreover, as with China and the US, the South African strategy recognises the importance of protecting national data through bolstering cybersecurity capabilities: “Data sovereignty will save money for the government and create new income streams when the data is mined,” the report states.

The US led with development and the announcement of ethics; China intends to do so only after it has developed its AI to an optimum level (earmarked for 2025-2030, according to its strategy). On the other hand, China has seemed more open to multilateral (global) ethical and regulatory standards-setting than doing so unilaterally: “China will actively participate in global governance of AI, strengthen the study of major international common problems such as robot alienation and safety supervision, deepen international cooperation on AI laws and regulations, international rules and so on, and jointly cope with global challenges.”

Finally, in the case of South Africa the following are identified: AI, blockchain, and additive manufacturing. On the other hand, China emphasises big data and various types of AI, and the US states that it is still to determine “an authoritative list” of key technologies, but mentions several (microelectronics, biotechnology, quantum computing, 5G, robotics and autonomous systems, additive manufacturing, and energy storage technology).

Relating the technologies to South Africa’s socioeconomic status, the country’s document reports that these should be applied towards agricultural, energy and healthcare needs . There are indeed limits to the extent to which South Africa may adapt the plans of China and the US, given the different contexts and capabilities each already enjoys. This is recognised in the South African strategy, which seeks to carve out a developmental approach to 4IR, whereas the other two are efficiency and security driven.

South Africa’s strategy is thus determined to be uniquely home-grown but with inevitable similarities and influences from China and the US. A missing element in the South African strategy is the dimension of time, however. All eyes in Beijing and Washington seem set on 2025, whereas South Africa is silent on this front.

[activecampaign form=1]

Bhaso Ndzendze is a research fellow at the African Centre for the Study of the United States (Wits University) and senior lecturer at the University of Johannesburg Department of Politics and International Relations as well as its 4IR and Digital Policy Research Unit. He holds a PhD in International Relations. His most recent books include Artificial Intelligence and Emerging Technologies in International Relations (World Scientific) and The Political Economy of Sino-South African Trade and Reginal Competition (Palgrave).